The Fighting Hunger Incentive Act of 2015 is a subpart of the America Gives More Act that states that food donations by businesses will receive the same enhanced tax deductions that C corporations have been receiving since 1976. On average, 40 percent of unsold fruits, vegetables and other food items go to waste in landfills. Upon passage of this bill, businesses would have more incentive to donate these items to local food banks and charities to help the hungry in America because they would receive tax breaks for doing so.

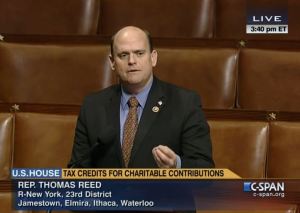

Republican Congressman Tom Reed, as well as other conservatives, favor this bill. “Fighting hunger is a bipartisan issue. We unite as Americans when our fellow citizens are suffering. When you look at the millions of Americans who are going hungry every day, Mr. Speaker, we shouldn’t be divisive,” said Reed.

The Fighting Hunger Incentive Act has earned the support of multiple food banks. Most notably, Feeding America, the largest antihunger group in America, and the National Council of Nonprofits support this bill.

The National Council of Nonprofits believes that with this bill, more people would be willing to volunteer their time and unused food in order to support nonprofits that aim to decrease hunger in America.

Their 2015 public policy agenda states, “Charitable nonprofit organizations throughout the United States are dedicated to the public good; their work improves lives, strengthens communities and the economy, and lightens the burdens of government, taxpayers, and society as a whole. The National Council of Nonprofits supports existing, enhanced, and new tax and other incentives at the federal level that encourage individuals to volunteer their time and contribute money to the missions of nonprofits.”

Even though Feeding America and the National Council of Nonprofits support this act, there are those who do not. The bipartisan Joint Committee on Taxation estimates that the bill would add $1.9 billion to the budget deficit after giving tax breaks to all of the companies that choose to donate food.

Ultimately, smaller companies and nonprofit organizations are in favor of this bill because they rely on the charitable services funded by the incentives given in the act.